How to Save My Property in Divorce in India

Divorce is never fun to go through. On top of the emotional turmoil, there’s also concern about what happens to everything you’ve built — your house, savings, business and other assets. If you are experiencing a divorce in India, then understanding the ways to legally safeguard your assets can help prevent financial woes later on.

This guide will take you through some practical measures to protect your house and assets in a divorce, while still (as much as possible) staying within the realms of Indian law.

The Importance of Asset Preservation in Divorce

When a marriage is over, one of the biggest worries is often what will happen to property and money. Unlike in some Western countries, where assets are automatically divided 50-50 when a marriage ends, India has different rules depending on which religion you belong to and whether you have a prenuptial agreement.

But many don’t know that, without good planning, they can lose as much as half of everything they own. Sometimes one partner will try to stash assets or transfer them to relatives. In other cases, people simply do not understand their rights and get stuck with a lopsided settlement.

Taking care of your interests is not a selfish or greedy idea. It is about making sure that you have financial security after the divorce and that there is an equal split in accordance with the law.

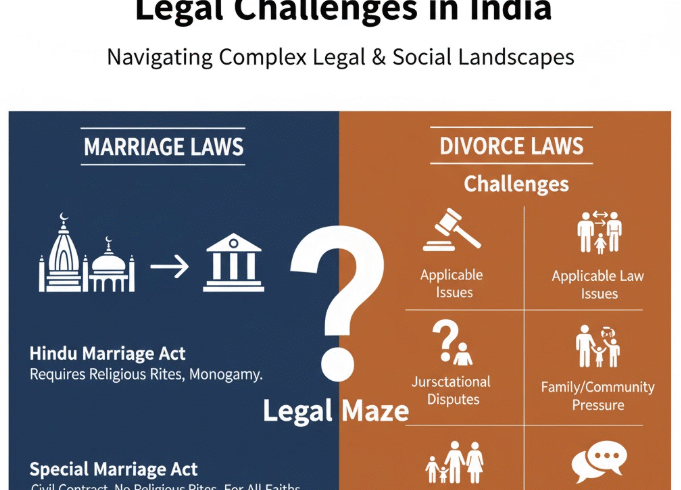

Indian Statutes Which Could Have Impact Upon Property Division

Before we discuss ways to protect, let us see the legal aspects in India.

Hindu Marriage Act, 1955

If you are Hindu, Buddhist, Jain or Sikh, the Hindu Marriage Act applies to you. Under this law:

- Spousal status doesn’t mean automatic entitlement to half your partner’s possessions

- The Judge may award maintenance (alimony) to the wife

- Property owned before marriage typically remains with the owner

- Assets acquired during marriage may be split using a proportional attribution formula

- The court takes into account earning capacity, requirements and conduct

Special Marriage Act, 1872

This is also valid for couples who were only civilly married, regardless of their denomination. Property provisions are equivalent to Hindu Marriage Act.

Muslim Personal Law

For Muslim couples:

- The wife has a right to receive Mahr (dower)

- She has a right to claim the maintenance for the period of Iddat (about 3 months)

- Apart from this there is no separate property division

- The idea of alimony is also different from all other religions

Christian Marriage Laws

In Christians, the laws relating to divorce decrees are under the Indian Divorce Act, 1869:

- Courts can order permanent alimony

- Property division varies by the individual situation

- Women can apply for maintenance and get share in property

What About Stridhan?

The concept is significant from the point of view of Hindu law. Stridhan means property of women, including gifts and ornaments received by a woman before, during or after marriage. It is her own movable property which no one—not even her husband or in-laws—can lay hands on.

For expert legal guidance on property matters during divorce, visit Zista Legalis.

Ways to Safeguard Your Wealth

1. Complete Inventory of All You Have

Begin by making a comprehensive list of all of your assets:

Personal Property:

- Bank accounts (savings, current, fixed deposits)

- Jewelry and precious metals

- Vehicles (cars, bikes)

- Electronic items

- Furniture and household goods

Real Estate:

- House or apartment

- Land plots

- Commercial properties

- Inherited properties

Financial Investments:

- Mutual funds

- Stocks and shares

- Bonds and debentures

- Insurance policies

- Provident fund (PF)

- Public Provident Fund (PPF)

- National Pension Scheme (NPS)

Business Assets:

- Company shares

- Partnership stakes

- Business equipment

- Intellectual property

Safely store all documents: receipts of purchase, bank statements, property papers, investment certificates and inheritance records.

2. Differentiate What’s Yours versus Shared

The Indian courts ordinarily follow three categories:

| Asset Type | Description | Who Gets It |

|---|---|---|

| Self-Acquired Property | Purchased with your own money before or after marriage | Typically to be retained by the owner |

| Inherited Property | From parents or family | Belongs to inheritor |

| Joint Property | Purchased in both names or jointly | Divided depending upon contribution |

| Gifted Property | By spouse’s family | Depends on circumstances and issues |

If you own the property and you paid for it with your own hard-earned money or inheritance, typically it is protected. But if your spouse helped pay for its purchase or repair, they could lay claim to some interest.

3. Document Your Financial Contributions

Keep proof of:

- Sources of income (pay slips, tax returns)

- Records of your payment on property purchase documents

- Loan EMI payments made by you

- Amounts you paid for home renovation or alteration costs

- If you paid tuition or the cost of a child’s medical treatment

This evidence is helpful in proving that some portion of assets were what you contributed to and support your side.

4. Open Separate Bank Accounts

If you and your partner still have joint accounts, think about:

- Opening an account in your name only

- Transferring your pay and income there

- Keeping enough cash to pay your living expenses

- Maintaining records of all transactions

Note: Do not deplete joint accounts or hide money away. This is viewed as fraud by the court. Take only what’s legitimately yours and document everything.

5. Protect Your Business Interests

If you own a business:

- Obtain a professional valuation by a chartered accountant

- Keep personal and business finances separate

- Document existence of the business predating marriage (where relevant)

- Demonstrate why the company is necessary to your living circumstances

- Review any partnership with partners who are not your spouse

Courts normally would not award the spouse ownership of your business, but they may consider its value when deciding alimony or settlement.

6. Update Nominations and Beneficiaries

Change nominations on:

- Bank accounts

- Insurance policies

- PF and PPF accounts

- Mutual funds and investments

This means that if you die, your assets go to the people whom you specifically choose — for example, your children or parents — instead of automatically to your spouse.

7. Secure Your Stridhan (For Women)

If you are a woman in the midst of divorce:

- Prepare an inventory of your Stridhan

- Capture images of jewelry and gifts

- Gather any receipts or cards provided as gifts

- Take statements from family members as witnesses

- If your in-laws are holding on to Stridhan, report a complaint at the police station

- Go to the court and seek Stridhan back

Keep in mind, Stridhan is your own property. Even if you are at fault in the divorce, you still have rights to it.

8. Be Careful with Property Transfers

Friends and family members are often on the receiving end of this sort of subterfuge, as some seek to transfer property without their spouse’s knowledge. This is a bad idea because:

- Courts are able to reverse such transfers

- That is fraud and it can harm your case

- You could end up losing the property outright

- It can result in criminal charges

If there is a valid reason for you to make a transfer of property (say, because of the sale of a house that you can’t afford to maintain), then do so openly and follow appropriate documentation.

9. Consider a Settlement Agreement

Settling between you is often better than fighting it out in court. Benefits include:

- Quicker resolution (litigation can drag on for years)

- Lower legal costs

- More control over the outcome

- Privacy (court proceedings are public)

- Less emotional stress

In an agreement you and your spouse decide on:

- Division of property

- Alimony or maintenance amount

- Child custody and support

- Return of Stridhan

Have a lawyer help you draft the agreement and legalize it by court.

10. Hire a Good Lawyer

This cannot be stressed enough. A competent family lawyer who understands Indian divorce and property laws will:

- Explain your rights clearly

- Assist to design a protection plan for you

- Negotiate with your spouse’s attorney

- Represent you in court

- Ensure all paperwork is correct

- Catch and watch for the hiding of assets from your spouse

Don’t attempt to save money by doing your own divorce, especially if there are large amounts of assets at stake.

Common Mistakes to Avoid

Hiding Assets: Courts have methods to unearth hidden assets, and if you’re caught, your credibility will go up in smoke along with your case.

Transferring Everything to Parents: While a little protection is okay, blatant attempts at making sure your name holds no assets prior to divorce doesn’t look good.

Failing to Keep Records: If you don’t have records, there’s no proof that something is yours or that you paid for it.

Verbal Agreements: Never make an agreement by mouth — always get it in writing and signed with a notary.

Overlooked Tax Consequences: Transfers of property or large settlement payments result in tax consequences. Plan accordingly.

Acting Vindictively: Attempting to inflict financial harm on your spouse usually doesn’t pay off. Courts favor fair settlements.

Delay in Taking Legal Action: If your spouse is threatening to sell property or wipe out accounts, you may want to move fast. File for injunctions if needed.

Special Situations

When Your Spouse Earns Nothing

Should you still be on the hook for maintenance if your spouse does not work or was the homemaker with no assets? If your spouse has no income or assets, it is possible to mandate maintenance against you based on:

- Time needed to acquire education/training so that they will become financially independent

- Your income and lifestyle

- Their needs and expenses

- Whether they can work and simply don’t

- Duration of marriage

- Their age and health

When You Have Children

The safety of kids is the central concern to the court. You’ll need to:

- Educate them and keep them healthy

- Maintain their lifestyle as before

- Not treat them as leverage

- Maintain availability of the family home for their use (in some cases)

When Property is Ancestral

There are special laws governing Hindu ancestral property. If you inherited it from a father or grandfather, your spouse generally cannot claim it. But if you were using income from the property for family expenses during your marriage, courts may take that into account.

When You’re a Woman Without Income

You have rights even if you didn’t work during marriage:

- Husband’s maintenance depending on his income

- Right of residence in the matrimonial home (Domestic Violence Act)

- Share if you contributed to a property purchased during marriage as a homemaker

- Your Stridhan

- Custody of young children (usually)

The Role of Prenuptial Agreements

Prenuptial agreements (prenups) are getting increasingly popular in India but they still aren’t fully recognized under all personal laws. If you had a prenuptial agreement before the marriage that specifically says:

- What each individual’s property share becomes in divorce

- Whether alimony will be paid

- How assets will be divided

It is something courts can consider, particularly under the Special Marriage Act. But prenups cannot override specific legal rights, such as Stridhan or child support.

If you’re not yet married but are headed to the altar, talk about a prenup, especially if:

- You own significant assets

- You are about to wed for the second time

- The disparity in income is big

- You own a business

- You have children from a previous relationship

Timeline: What to Expect

Here is a general idea of how asset protection and division occurs during divorce:

Months 1-3:

- File divorce petition

- List all assets and liabilities

- Each party discloses their property

- Petition for interim maintenance, if appropriate

Months 3-6:

- Court might order asset preservation (so nobody can sell)

- Both sides exchange financial documents

- Negotiations for settlement begin

- Valuation of properties conducted

Months 6-24:

- Court hearings continue

- Evidence presented

- Witnesses examined

- More settlement negotiations

Months 24+:

- Final arguments

- Court ruling regarding divorce and property division

- Implementation of orders

Uncontested divorces are significantly quicker (6-18 months), while contested ones normally take 3-5 years or more.

How Courts Decide Asset Division

Court decisions are not made by an exact formula in India. They look at:

Who Brought What: Property brought to marriage usually leaves with the spouse who brought it, unless the other helped maintain it.

Contribution as a Homemaker: Courts are beginning to understand that raising kids and managing the household is considered a contribution despite not earning money for it.

Length of Marriage: The longer the marriage, perhaps the more assets will be divided equally.

Standard of Living: Maintenance should be sufficient to allow the dependent spouse to live in a style that is consistent with what he or she is used to.

Future Earning Potential: If one spouse gave up career for family, this is relevant.

Conduct: If one spouse is at “fault” in some way that caused the divorce (adultery, cruelty), it can impact claims for relief.

Children’s Needs: Resources might benefit children, depending on how they are used.

The Parties’ Requirements: Age, health and ability to support oneself.

For more information on family law matters in India, you can refer to resources from the Bar Council of India.

Tax Considerations

Property transfers during divorce may have tax consequences:

Capital Gains Tax: You might owe tax on profits if you sell the property. But inter-spouse transfers as part of divorce settlements may be exempt under some circumstances.

Alimony Income Tax: For the receiver, alimony received is not taxed, and for the payer no deduction can be claimed (as per current tax code rule).

Stamp Duty: When property is transferred, stamp duty may apply, but some states have concessions where the transfer of property occurs as part of a divorce.

Take advice from a chartered accountant to reduce tax liability.

Frequently Asked Questions

Q: Can my wife demand 50% of property in India?

A: No, Indian law doesn’t have automatic 50% rights as in some Western countries. It’s based on who earned what, who contributed and any number of other factors. But judges can also order maintenance and take into account the wife’s indirect contributions.

Q: Is premarital property safe from division?

A: Probably, if you financed it entirely with your money and your spouse didn’t do anything to maintain or improve it. Retain all purchase records.

Q: Can I sell my house while going through a divorce?

A: Once a divorce case is filed, you should not sell assets without the court’s knowledge. Your spouse has the legal ability to file an injunction to stop the sale. If you are in a position of having to sell and it is for genuine reasons, go before the court.

Q: What if my spouse has assets I don’t know about?

A: You can file in court for the discovery of assets. Courts can then order that bank accounts, property records and investments should be disclosed. Concealing assets may be considered fraud and can lead to penalties.

Q: Am I required to split my inheritance?

A: Inherited property normally remains with the person who inherited it. But if inheritance money was spent on family expenses or blended with joint resources, there could be some claims.

Q: Can my husband get away with taking all of my jewelry?

A: No, Stridhan is your exclusive property even if gifts are made to you in any form. If your husband or in-laws refuse to give them back, then you can file a police complaint and approach the court.

Q: How can a business be divided in divorce?

A: The ownership of a business generally remains with the person who owns and manages it. But its worth might factor into the equation when calculating alimony or value of assets in a settlement. Business division is rarely ordered by the courts because it could interfere with a company’s operations.

Q: Are prenuptial agreements valid in India?

A: Prenups aren’t fully enforceable in most personal laws of India, but courts might consider them as evidence of the parties’ intent, particularly under the Special Marriage Act. These are likely to be supported where they are fair and both sides had their own legal advice.

Q: What about joint home loans?

A: You’re jointly liable on the loan until it’s repaid. Courts can force one spouse to buy out the other’s interest, or sell the property — with proceeds to be divided upon paying off a loan. You can also work out who gets the property and assumes total loan responsibility.

Q: Can I get maintenance if the divorce was my fault?

A: Yes, in most cases. Even if you were at fault in your divorce, you can still be eligible for maintenance if you are financially dependent. But according to Hindu law, if a wife is found in the act of adultery, her claim towards maintenance can be denied.

Final Thoughts

Safeguarding your assets during divorce in India while being fair as per law requires careful planning. It helps to start early, maintain good records and never attempt to cheat the system — it always comes back to bite you.

Keep in mind that no two divorces are alike. Laws and the way they are enforced may differ depending on your religion, region and specific situation. The thing that’s right for your friend or relative might not be the thing that’s right for you.

The best approach is to:

- Stay informed about your rights

- Do not allow emotions to cloud your judgment of financial matters

- Document everything

- Work with qualified professionals

- Settle if you can, don’t drag it out in court

- Concentrate on the after-divorce financial future

Divorce may be a painful process, but with the proper asset protection you can start over with financial security and peace. Take the right steps now, and you’ll have a better shot at making whatever comes next in your life more enjoyable.

For comprehensive legal assistance with divorce and property matters, contact the experts at Zista Legalis.

This article is for informational purposes only and does not constitute legal advice. Please consult with a qualified lawyer for advice specific to your situation.