The Legality of Budget 2025: A Complete Legal Guide

Guide to Indian Budget: Appropriation and Finance Bills

Complete Encyclopedia on India Union Budget 2025 – A complete manual on Indian budget: A study of all the aspects of the financial year, including assigned resources.

Each year, the Indian government introduces its budget, and most people pay attention to tax rates and spending plans, not realizing that there’s a whole legal patchwork that makes the budget able to be enforced. Budget 2025, just like all other budgets that came before it, has to comply with stringent constitutional and legal standards. In simple words, we break down the legal aspect of Budget 2025 to help you understand how laws determine India’s financial planning and how it affects citizens.

Constitutional Basis of Indian Budget

The Union Budget is not only a financial document but also a constitutional mandate. Provisions 112 to 117 of the Indian Constitution contain elaborate provisions regarding the budget procedure. Article 112 mandates the President to lay before Parliament an “Annual Financial Statement” which we call the budget locally.

This constitutional obligation implies the government cannot spend a penny without Parliament’s nod. It is one of those core principles of government that the duly elected representatives of the people must approve how public money is raised and spent. Budget 2025 takes the same constitutional route through which India’s budgets have been presented since Independence.

Why Constitutional Rules Matter

The Constitution has a checks and balances system. The budget is proposed by the executive branch (the government), but it needs approval from the legislative branch (Parliament). This is in order to avoid a situation where one group has power over public money without accountability. That means everything in Budget 2025 — tax changes, new schemes — requires Parliament’s OK.

The Finance Bill: A Place Where Tax Laws Are Born

One of the most significant legal documents in Budget 2025 is the Finance Bill. This is the bill that will have all of the changes to tax law. During budget speech by the Finance Minister, in which taxes to be increased, reduced or charged is notified under the Finance Bill 2025.

Salient Features of the Finance Bill 2025

- 85% – Direct Tax Changes

- 70% – Indirect Tax Updates

- 55% – Customs Duty

- 90% – GST Amendments

There is a unique legal position of the Finance Bill. It is a Money Bill under Article 110 of the Constitution, not an ordinary bill. It’s the reason the Rajya Sabha (upper house) cannot reject it — they can only propose amendments. The lower house, the Lok Sabha, has the final decision. This is what makes the Finance Bill one of government’s most potent pieces of legislation.

Budget 2025: Changes in Direct Tax

Budget 2025 usually consists of changes in the Income Tax Act, 1961. These changes could pertain to income tax slabs, deductions or exemptions. Each and every item in the Bill will become a law, as soon as Parliament approves it – generally by 31st March of the financial year.

| Tax | Nomenclature | Legal Authorization | Changes Brought Through |

|---|---|---|---|

| Income Tax | Income Tax Act, 1961 | Finance Bill | Income Tax Act, 1961 |

| Corporate Tax | Income Tax Act, 1961 | Finance Bill | Income Tax Act, 1961 |

| GST | GST Act, 2017 | By GST Council + Parliament | GST Act, 2017 |

| Customs Duty | Customs Act, 1962 | Through Finance Bill | Customs Act, 1962 |

For more insights on legal and financial matters, visit zistalegalis.com.

Appropriation Bill: The Legal Authority to Spend

Finance Bill deals with taxes and, Appropriation Bill gives the legal authority to incur expenditure from the Consolidated Fund of India. As per Article 114 of the Constitution, money cannot be withdrawn from the Consolidated Fund of India without an Appropriation Act enacted by Parliament.

Consider it this way: Budget 2025 announces several new schemes and projects, but then the government can’t actually spend money on them until the Appropriation Bill is passed as an Act. This is usually after the Finance Bill has been enacted.

Quick Legal Fact

The Appropriation Bill is also a Money Bill so it too can be put on the same fast track as the Finance Bill. The decision of the Lok Sabha is conclusive and must be approved by the President.

Vote on Account

Definition: Temporary authority to spend.

Budget 2025 is to be unveiled in February, while the new financial year commences from April 1. What if Parliament has not approved the budget in full by then? Here comes the “Vote on Account”.

Article 116 lets the government ask for approval by Parliament to spend modest sums for a few months. This prevents government operations from shutting down while the larger budget is debated. It’s a legal stopgap to keep the wheels of government spinning.

What is Vote on Account and How it Differs from Full Budget

A Vote on Account provides only for the most essential, like salaries, running schemes etc. It presents no radical plans or wholesale policy changes. Those demand the full Appropriation Act passed. While for Budget 2025, which can be delayed, there is enough in the Vote on Account to carry on.

Playing the CAG Card

According to Budget 2025’s legal framework, CAG has to be compulsory audited. The CAG (Articles 148-151) is an independent authority which audits all receipts and spends of the Government. The job of the CAG is to make sure that money voted by Parliament under the Appropriation Act is spent according to law.

CAG’s Legal Powers

The CAG may examine any expenses from the Consolidated Fund of India. CAG has the right to appeal to Parliament in case any irregularities are observed. This ensures legal accountability—a government department cannot squander money without being called to account. CAG reports of Budget 2024 expenditure will have an impact on the provisions for Budget 2025.

Legal Challenges to Budget Provisions

If budget provisions infringe constitutional rights, citizens can contest it in court. The budget is a parliamentary business but, its particular provisions could certainly be subject to legal challenge. For instance, if there is a discriminatory or a fundamental right-infringing tax in Budget 2025, it can be challenged under Article 32 (Supreme Court) or Article 226 (High Courts).

The court has recently struck down tax sections as unconstitutional. While taxing power is extensive, the Supreme Court has stated that it should be curtailed by other constitutional provisions. This case-law impacts Budget 2025.

Legal Challenge Types

| Legal Challenge Type | Constitutional Basis | Example |

|---|---|---|

| Discriminatory Tax | Article 14 | Unequal Similar Tax |

| Excessive Tax Burden | Article 19 | Destroys business viability |

| Retrospective Tax | Article 20 | Tax over past transactions |

| Arbitrary Classification | Article 14 | Random Similar Tax |

GST in Budget 2025: A Special Legal Framework

The Goods and Services Tax has unique framework. Article 246A and Article 279A created the GST Council. Changes in GST require Council approval for both Central and State government to pass specific GST changes. The Finance Minister cannot act in isolation.

Since GST affects state revenue, laws on compensation cess must be addressed in Budget 2025. The GST requires the Centre to compensate states legally.

For detailed analysis on constitutional provisions, refer to India Code.

Fiscal Responsibility and Budget Management (FRBM) Act

Law on fiscal responsibility imposes some limits on expenditures. If Budget 2025 exceeds FRBM limits, the government must provide legal justification to Parliament. In cases of emergencies or exceptional circumstances, deviations are authorized by Parliament. However, such deviations require formal explanations and timelines for return to legal limits.

Parliamentary Procedures for Budget Approval

Budget 2025 had to follow a strict legal time frame. The Constitution stipulates procedures that must be followed and cannot be circumvented:

Budget Legal Timeline

- 1st February: Budget presentation by Finance Minister

- February-March: Discussion in Lok Sabha and Rajya Sabha

- Voting on Demands for Grants: MPs vote independently on each ministry’s budget

- Finance Bill passage: The Bill must be passed before 31st March

- Appropriation Bill passage: Should follow the Finance Bill

- President’s assent: Final for legal validity

Each procedure has legal significance. The Demands for Grants allow Parliament to discuss ministry-wise spending. MPs can vote cut motions to reduce allocations. Even if cut motions rarely succeed, they provide a legal path to Parliamentary oversight.

Legal Protection for Government Spending

Article 112 protects some government spending. “Charged” expenditures are not voted by Parliament and are automatically approved. They include the President’s salary, salaries of Supreme Court judges, and interest on government loans.

Budget 2025 must show charged and voted expenditures separately. The legal distinction ensures that some critical constitutional functions continue even if there are political disputes. Salaries of judges and some key constitutional office holders cannot be at the whim of budget discussions.

Legal Rights of Citizens in Budget Process

While Budget 2025 is a government function, citizens enjoy certain rights in its proceedings. Under the Right to Information Act, citizens can request the Budget documents and explanations from the government. The government is legally bound to provide this information in 30 days.

Pre-Budget Consultation

While not mandatory under the law, there have recently been pre-budget consultations. These consultations do not generate legal rights but demonstrate transparency and enable citizen input into Budget 2025.

-

📚 See what Indian courts have said about taxation. Explore more: Understanding Taxation Through Indian Court Judgments

State Budgets: Federal Legal Framework

There are two budgets: one the Union Budget, and states also give theirs. The state budget is laid down in Articles 202 to 207 of the Constitution. State legislatures follow similar procedures. The legal structure ensures both Union and State governments do not exceed the constitutionally defined limits.

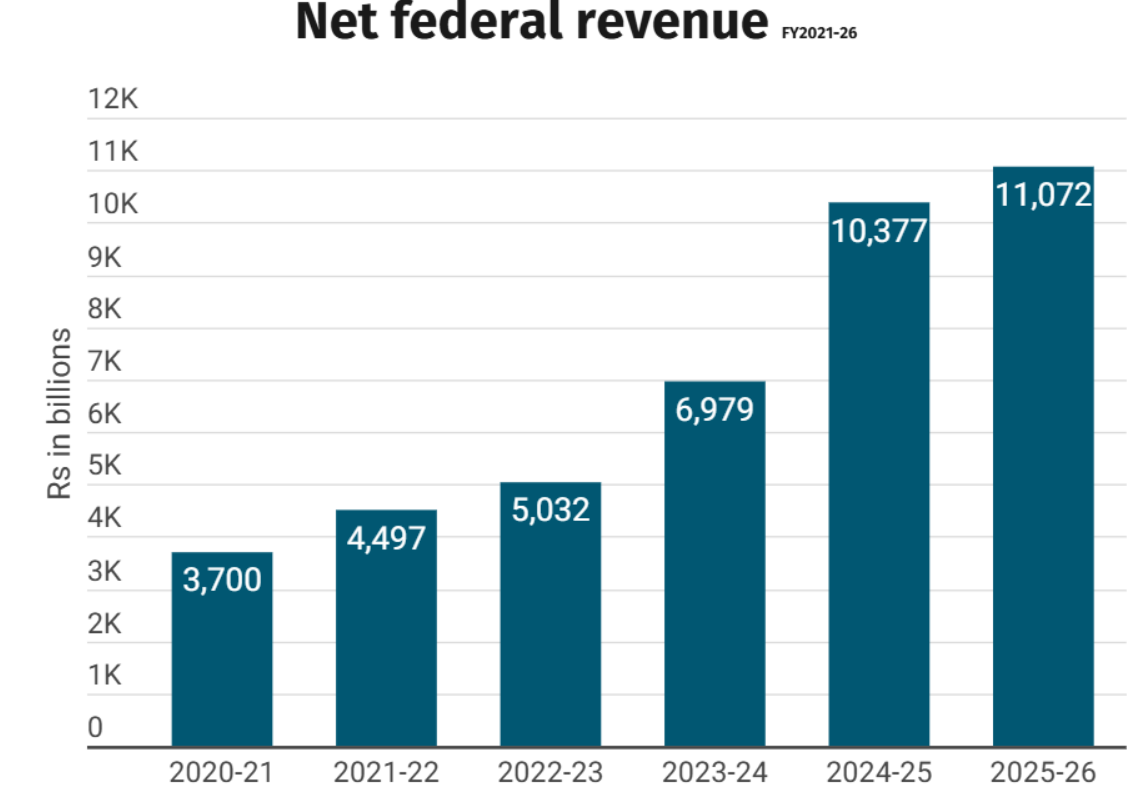

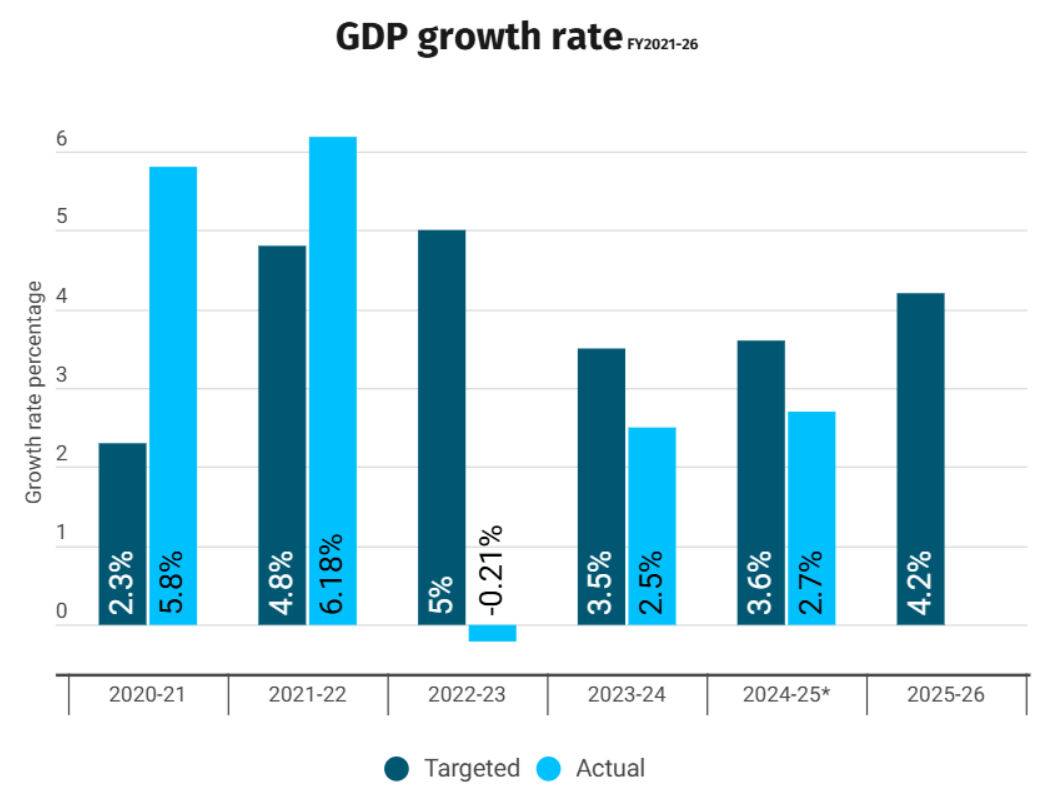

Budget 2025 would need to provide for Central transfers to states, as prescribed by law through the Finance Commission. The recommendations of the 15th Finance Commission (2021-26) legally bind Budget 2025 to devolve certain proportions of tax revenues to states.

Transfer Types

| Transfer Type | Legal Basis | Percentage/Amount |

|---|---|---|

| Tax Devolution | Article 270, Finance Commission | 41% of divisible pool |

| Grants-in-Aid | Article 275 | As recommended by FC |

| Disaster Relief | Disaster Management Act | Flexible, on merits |

| GST Compensation | GST (Compensation) Act | As revenue deficient |

Legal Consequences of Non-Implementation

What if Budget 2025 promises are not delivered? Though governments have flexibility in implementation, some budget allocations generate legal entitlements. If Budget 2025 allocates money to a welfare scheme, there could be legal basis for beneficiaries to petition for implementation.

Courts have determined that when Parliament approves a budget allocation for a particular purpose, government has an obligation to work hard at spending that money correctly. Unaccounted non-spending from allotted budgets may attract judicial attention.

Legal Provisions in Budget 2025

Each budget contains several novel legal rules. Budget 2025 may include provisions about:

- Amendments to Direct Tax Laws in terms of the tax slabs and exemptions

- Changes in indirect taxation rules

- New compliance requirements for taxpayers

- Updating of tax evasion penalty provisions

- New modes of collecting taxes introduced

- Modifications to tax appeal procedures

All of these changes have implications for legislation and must be made by the Finance Bill. They are not achievable by executive action alone. This guarantees legislative review of tax policy.

International Treaty Obligations

Budget 2025 must also conform to India’s international treaty obligations. If India has signed trade treaties or taxation pacts with other countries, they cannot be violated by the budget. In the same way, the WTO rules that certain types of subsidies and tariffs are allowed. In order to prevent disputes, Budget 2025 provisions should respect the international law framework.

Frequently Asked Questions (FAQ)

Q1: Can the government alter tax rates without Parliament’s permission?

Answer: No. The government cannot alter tax rates without the Finance Bill becoming legislation. In other words, any change in tax levies is bound by law to be approved by the top legislative body. However, the government can change certain rates or impose small fees based on administrative necessities without requiring the go-ahead of the Parliament.

Q2: What legal recourse do I have if Budget 2025 imposes an unfair tax on me?

Answer: Unfair or discriminatory tax levies can be contested in the court of law. A citizen can either approach the High Court under Article 226 or approach the Supreme Court under Article 32. The tax may be struck down if it is manifestly arbitrary or if it infringes on the fundamental rights of an individual.

Q3: From when do the tax laws of Budget 2025 kick in?

Answer: Most tax amendments become effective on April 1, 2025. However, a section of this document will be in operation from the day the Parliamentary Budget session opens, and the rest will become effective after the president gives its assent.

Q4: Can Rajya Sabha reject Budget 2025?

Answer: No, Rajya Sabha cannot reject the budget. Both Finance Bill and Appropriation Bill are Money Bills under the Constitution. The Lok Sabha has the final authority. Rajya Sabha can only suggest amendments and Lok Sabha can accept/reject them. This ensures the government can pass its budget because it always has a majority in the Lok Sabha.

Q5: Is the government legally bound to implement everything announced in Budget 2025?

Answer: The government has legal authority to spend only the amounts approved by the Parliament through the Appropriation Act. While the budget speeches may announce intentions and policies, only formally approved amounts become legal entitlements. However, if Parliament approves amounts for some scheme, the government must make reasonable efforts to implement them.

Q6: What happens if the government spends more than budgeted in 2025?

Answer: In such cases, the government can seek supplementary grants from the Parliament under Article 115. The process is the same as the main budget. The government cannot spend beyond parliamentary authorization—it is illegal. CAG will audit it and Parliament will scrutinize it.

Q7: Are all budget documents legally required to be public?

Answer: Yes, under transparency norms the budget documents must be made public. The Constitution requires the Annual Financial Statement to be laid before the Parliament, hence it is a public document. Citizens have legal rights to see it. However, there are some expenditures on security which will not be presented with full details.

Q8: Can retrospective tax laws be introduced in Budget 2025?

Answer: Although retrospective legislation is permissible under the Constitution, retrospective taxation is a topic of controversy and has been challenged in the courts. The government has largely shied away from retrospective tax amendments post the Vodafone case controversy. Retrospective provisions, if any, in Budget 2025 can be subjected to legal scrutiny if they violate principles of fairness or legitimate expectations.

Wrapping It All Up

There are more than numbers and announcements in Budget 2025—it is a complex legal text that respects constitutional regularity and generates binding legal commitments. All aspects of the budget are bound by a rigid legal framework – from its components such as the Finance Bill to amend tax laws, to the Appropriation Act which sanctions expenditure.

For the average citizen it provides accountability, transparency and democratic control over public funds. Requiring parliament approval eliminates arbitrary taxation and spending. Audit powers of CAG ensure that money is spent legally. They curb unconstitutional provisions on the statute books.

As Budget 2025 rolls out, keep in mind that at the heart of every tax change and spending proposal is a set of legal arrangements designed to protect both government’s need to operate and everyone’s rights to be treated fairly. The legal side of the budget can seem difficult to understand, but it is essentially about protecting the idea that democratically chosen priorities should determine how our country raises and spends its funds.

If you’re a taxpayer or a business operator, or just someone who has an interest in understanding the Budget, then understanding the legal aspects of Budget 2025 helps you make more informed choices. It empowers you to appreciate the checks and balances that make India’s financial system run. It is this legal architecture that turns budget proposals into laws that shape the lives of millions across the country.

For more legal insights and updates, visit zistalegalis.com.

This article provides a comprehensive overview of the legal framework governing India’s Union Budget 2025, helping citizens understand the constitutional and legal aspects of fiscal policy.