The Real Price of Tax: Here’s How It’s Eating India’s Growth

You work hard for your money, and then you watch a large chunk of it vanish before it even lands in your hands. And that is exactly what happens with taxes in India. Though taxes are a key source of funding for roads, schools and hospitals, there is an increasing concern that our current tax system may be doing more harm than good to the nation’s economic growth. Let’s delve deeper into what taxes mean when it comes to India’s progress, and ultimately how you and I, the common people of this country, are impacted by them.

Why You Pay Taxes (and Why They Matter More Than You Think)

Whenever you purchase a chocolate bar, put petrol in your vehicle, and get paid your salary – that’s when you pay taxes! The Government of India raises money from its citizens in a variety of ways. Some taxes are right there in front of you, like Income Tax. The price of other things you buy contains them, such as the GST (Goods and Services Tax).

The government also mobilized taxes of around ₹27.16 lakh crore in 2023-24. That is a stunningly large sum of money! To put this in perspective, if you made ₹1 lakh every day of your life, it would take you over 7.4 crore days (or around 2 lakh years) to accumulate that much money.

Quick Facts

- ₹27.16L Crore: Total Tax Collection (2023-24)

- 18%: Maximum GST Rate

- 30%: Highest Income Tax Slab

The Heavy Toll on Ordinary People

Income Taxes: The Government After Your Wallet

Direct taxes are the ones you send directly to the government. Most popular is Income Tax. In India, if you earn over ₹3 lakh a year under the new tax regime (as of 2024-25), you are liable to pay income tax. The more you make, the higher your percentage payment.

| Yearly Income Bracket | Tax Rate (Proposed Regime 2024-25) | Example of Tax Amount |

|---|---|---|

| Up to ₹3,00,000 | 0% | ₹0 |

| ₹3,00,001 to ₹7,00,000 | 5% (on the income between ₹3L and ₹7L in a year) | ₹20,000 (on ₹7L income) |

| Above your tax slab limit | 10% (on the portion over & above the limit for each slab) | Calculate using tax calculator |

But that’s not all. People with income beyond ₹50 lakh also pay an extra surcharge. And what’s more, there is also a 4% Health and Education Cess. This implies that someone with an income of ₹50 lakh a year would actually pay about ₹14-15 lakhs in taxes – i.e., almost 30% of their total income!

Indirect Taxes: The Hidden Thief

Indirect taxes are sneakier. They lurk in the prices of what you buy. GST is the largest single tax in India today. GST, which replaced many older taxes and was meant to simplify things, was introduced in 2017. But has it really?

There are different slabs for different products on GST. Rice, wheat etc are GST free, while cars might have 28% GST. What it means is, buying a ₹10 lakh car actually costs you an additional at least ₹2.8 lakh in pure GST alone!

GST Rates on Common Items

| GST Rate | Items |

|---|---|

| 0% | Rice, Wheat |

| 5% | Tea, Coffee |

| 12% | Computers |

| 18% | Soap, Toothpaste |

| 28% | Cars, AC |

For more detailed information on tax regulations, visit zistalegalis.com.

How Taxes Are Dooming Business Growth

Small Businesses are Most at Risk

India’s small and medium businesses are the foundation of its economy. They are home to millions of employees and make a major contribution to GDP. But that high taxation makes it difficult for them to expand.

Take Rajesh, the owner of a small clothing store in Mumbai. He purchases clothes from manufacturers and pays GST on the purchase. Then when he sells those clothes, he collects GST from customers. He also has to file monthly GST returns, keep extensive records and be compliant with tax laws. Make one wrong move, and he pays heavily.

Real Impact on Businesses

Recent stats suggest that companies waste 250+ hours a year on tax compliance alone. That’s OVER 30 BUSINESS DAYS dedicated to paperwork, instead of focusing on building your business!

The scenario is even grimmer for manufacturing companies. They pay corporate tax (25.17% inclusive of surcharge and cess for domestic companies), GST on raw material, GST on end product and various state taxes. All those layers of taxing eat into their profit margins, giving them less to invest in growth or new hires.

Why India Has So Few Foreign Companies

When multinational firms choose where to locate factories or offices, they consider lots of things. A big one is the tax burden. India’s tangled tax system and high rates can at times inhibit foreign investment.

Next to other countries such as Singapore (17% corporate tax) or Vietnam (20% corporate tax), India’s effective tax rate appears less attractive. Despite the market of 140 crore people and growing market in India, high tax makes companies reluctant to invest big amounts in the country.

Common Men and the Ripple Effect

“If you have to pay more for something, it means that is less purchasing power.”

When businesses pay high taxes, they don’t just eat the cost. They pass them on to consumers in the form of higher prices. That makes everything from your daily groceries to your children’s school fees more expensive.

Let’s take a simple example. A toy manufacturer pays corporate tax on its profits, GST on the raw materials and then GST again on the final product. All these taxes add up. If the actual manufacturing cost of a toy is ₹100, it may reach ₹180-200 in your child’s hand due to taxes being levied on them.

Fuel Prices: A Perfect Example

More than 50% of petrol prices are taxes in many states. When the price of petrol is ₹100 per litre, around ₹50-60 is collected as central excise duty and state VAT by the government. This high cost of gas adds to the cost of transporting, thereby raising the price on everything that needs to be shipped — which is just about everything we consume daily!

Job Creation Takes a Hit

When businesses are overtaxed, they find ways to cut back. This frequently leads to hiring fewer people and, in some cases, letting go of existing workers. High taxes also discourage entrepreneurship. There are so many young people with great ideas for businesses that they never follow through on, because they look ahead and see the daunting tax maze.

India must generate around 1 crore (10 million) jobs annually to absorb its youth population. But when taxes on business profits begin to rise, companies grow more cautious about expanding and hiring.

Government Spending: What Is Tax Money Actually Used For?

To be fair, the taxes aren’t really being taken away for nothing. This is the money the government spends on general welfare. This is how the government planned to spend money in the 2024-25 budget:

| Sector | Allocation | % of Total Budget |

|---|---|---|

| Interest Payments (on Debt) | ₹11.6 lakh crore | 20.2% |

| Defense | ₹6.2 lakh crore | 10.8% |

| Central Sector Schemes | ₹5.5 lakh crore | 9.6% |

| Finance Commission Transfers | ₹5.3 lakh crore | 9.2% |

| Subsidies | ₹3.8 lakh crore | 6.6% |

| Pensions | ₹2.5 lakh crore | 4.4% |

Notice something interesting? The single largest expenditure is interest payments on the loans the government took out in the past. That’s over ₹11 lakh crore just to pay the interest – not even paying down the principal! And here is a crucial question: are we taxing to develop or, instead, to pay for past borrowing?

India and Other Emerging Markets

As we look at other developing countries, what we find is a range of ways to tax. China, which has grown quickly over the last few decades, had relatively business-friendly tax policies as it was growing. Vietnam provides tax holidays (periods of 0 percent tax) for foreign companies to come in. Bangladesh has less complex tax regimes for small firms.

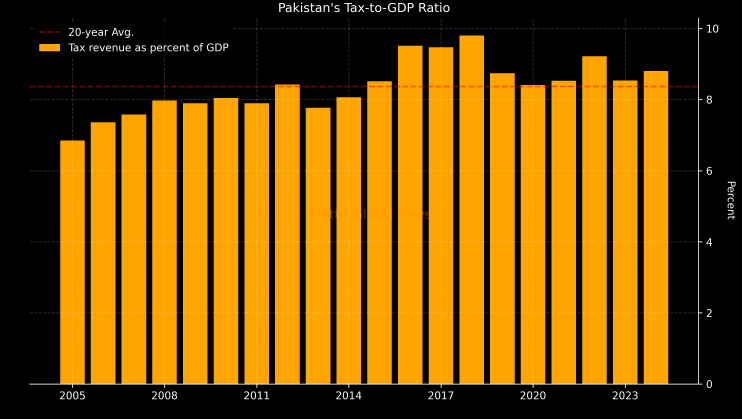

The tax-to-GDP ratio (measure of the amount of taxes collected as a percentage of GDP) in India is about 17-18 percent. This is similar to other developing countries. But the complexities of tax compliance and layers of taxation add further weights that don’t show on simple percentage scores.

To understand more about economic policies and taxation, you can visit the Ministry of Finance, Government of India.

The Compliance Nightmare: How Paperwork Destroys Productivity

But there is a much larger cost, in addition to actual tax payments: compliance. From the Income Tax Department and GST Network to state tax authorities, Indian businesses have to liaise with a plethora of different agencies. They each come with their own filings, documents and follow-ups.

A medium-sized company may be required to file monthly GST returns (12 times), quarterly TDS returns (4 times), annual income tax return, and keep accounts in detail. Failing to meet a deadline, or making an error, can cost you in penalties and interest, or at worst give the tax people a reason for prosecution.

The Digital Divide Problem

While most tax processes have also gone online, with the GST portal and Income Tax even making e-filing mandatory in certain cases, this has been problematic for small businesses with operations in rural areas or run by elderly people who are not familiar with technology. They will have to retain accountants or tax advisors — which will add to their costs.

What Can Be Done? Possible Solutions

Simplify the Tax Structure

India requires a simpler tax system, one in which people and businesses can easily calculate what they owe. A smaller number of different tax rates and slabs would definitely help. Even as of now, GST has several rates (0%, 5%, 12%, 18%, and 28%) – causing confusion & problems in compliance.

-

🚀 Are startups safe from tax burdens? Find out here: How India’s Tax Laws Impact Startups in 2025

Lower Tax Rates to Increase the Tax Base

In a country of 140 crore, only 6-7 crore Indians pay income tax. That’s under 5% of the population! Rather than imposing onerous taxes on these few, the government should dedicate more effort to bringing others into the tax net by making it less burdensome and more attractive to comply.

Less taxation also reduces the incentive to cheat on taxes. Today’s high rates foster tax evasion, which is the hiding of income to escape taxation. If taxes were reasonable, more individuals would be willing to pay.

Reduce Compliance Burden

The government should leverage technology to make tax filing automatic and easy. Pre-filled tax returns could reduce errors and save time. This is something that Singapore and several European countries already achieve.

Focus on Productive Spending

When people see what is done with their tax money — stronger roads, decent schools, good hospitals — then they feel ready to pay taxes. But today corruption, inefficiency and squandering decrease public trust in the system.

For expert legal advice on tax matters, consult professionals at zistalegalis.com.

The Path Forward: Growth vs. Revenue

India is at a defining moment. Our population is younger, our digital infrastructure growing and the global attention rising. But if we really want to unleash our potential, we need to rethink our taxation system.

We need taxes — no one would disagree. Roads, schools, defense, healthcare all obviously need to be funded. But the system as it exists does need reform. Heavy taxation that stifles business expansion, consumer spending and creates a compliance headache hurts the economy more than it helps.

In other countries, lower, simpler taxes have actually been shown to lead to higher total tax collection because more people and businesses comply, the economy grows faster and incomes rise. India should learn from these examples.

The Bottom Line

The actual cost of taxation in India is not just the rupees collected. This includes the businesses that never got off the ground, jobs that were never created and the innovations that died in the womb; it takes into account economic growth we could have had but didn’t.

Taxes will be a part of any working nation, but India needs to find a better balance. A simpler, lower and more transparent tax system would obviously be good for everyone – citizens, businesses, and even the government with a faster growing economy.

As citizens, we deserve better use of our tax dollars and simpler tax processes. As a country, we have to come to terms with the fact that in our headlong dash for economic growth, our tax system may be holding us back rather than propelling us forward. The question is: Will we reform it in time, or will high taxes continue eroding away our growth potential?

Frequently Asked Questions

Q1: Why does India need so many taxes?

India has many taxes because its Constitution distributes tax powers among the central and state governments. Income tax, customs duty and central GST are collected by the central government while state GST, property tax and other local taxes are a part of state revenues. This division was intended to provide both levels of government with a source of revenue, but it has resulted in an unwieldy situation.

Q2: What is the impact on everyday prices of high taxes?

High taxes lead to higher production costs for businesses, who then pass off those increases onto consumers in the form of higher prices. Just to quote an example, if 28% GST is applied on a product and there are levels of taxation in the chain right from the raw material, you can expect that the final price would be way more than what it should have been considering only manufacturing cost.

Q3: Are Indian taxes higher than other countries?

India’s highest personal income tax rate of 30 percent (plus surcharge and cess) is moderate as compared to developed nations. But when you add GST and other indirect taxes, the overall burden is high. Other countries with much lower tax rates have seen their economies grow rapidly, i.e. Singapore and UAE.

Q4: What happens if someone doesn’t pay taxes in India?

There are some pretty serious repercussions of not paying taxes, which can include penalty charges (usually 50-200% of tax owed), interest on any unpaid amounts (often 1% per month), being prosecuted under tax laws and possibly even going to jail, particularly in the case of serious tax evasion. In recent years, the government has taken a tougher line on tax enforcement.

Q5: Will lower taxes, in fact, help the economy grow more quickly?

Yes, most economists agree that moderate levels of taxation can promote growth. Low taxes leave more money in people’s hands to spend and invest, enable businesses to grow and hire workers, attract foreign investment and reduce tax evasion as it becomes easier for people to pay. But the government also requires funds to ensure public services, so it’s all about finding the right balance.

Q6: Why don’t more Indians pay income taxes?

This is for several reasons — many Indians earn under the taxable limit, there is a huge informal economy with cash transactions that don’t get declared, tax evasion by some, and complicated filing processes that discourage compliance. A simpler system and greater awareness could help bring more people within the tax net.

Q7: What could India do to reform its tax system?

India can improve by simplifying tax slabs and rates, lowering the compliance burden with better technology, lowering tax rates to increase voluntary compliance, moving more people into the formal economy, reducing corruption in tax administration, and ensuring transparent use of taxes so that citizens can see where their money goes.